The necessity of a tactical retreat

That 2020 pay reduction and the unsustainable rent I was paying in London felt like a punch to the gut. As a Product Owner, I analyse systems for inefficiency; suddenly, my own life was the most inefficient system of all. The decision to move back in with my mum was a personal challenge, but it was also the most powerful strategic move I could have made.

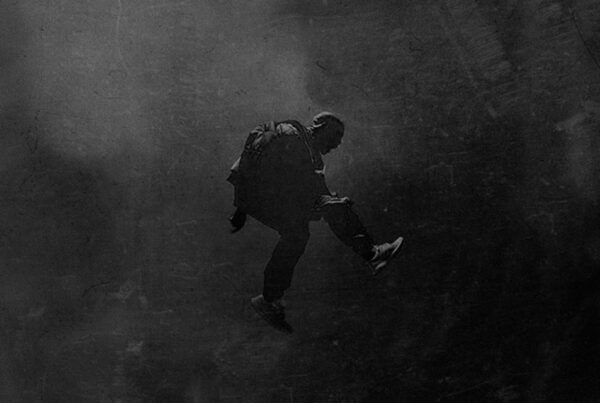

It was a difficult, humbling period, yet it gave me a fierce sense of purpose. Every month, the money I wasn’t wasting on rent became focused capital for my future. It wasn’t just savings; it was the active, month-by-month building of my own personal escape route back to the city I love. I was treating my savings not as a pot of money, but as an asset that needed to be protected and organised for a single, high-stakes deployment. The constraint was intense, but the dream of getting my own keys made the sacrifice feel absolutely worth it.

A deeply personal investment in context

My role requires making high-judgement decisions on product scale; my property purchase in February 2022 required the exact same level of belief and risk. I felt it in my bones: London was coming back. The lull was over, and the window to buy strategically was closing fast.

My thesis was entirely personal. I needed a home, but I also needed a context for my next professional jump to Head of Product. I’d read that idea on Reddit—that you subconsciously morph to reflect the people around you—and it resonated deeply. I wanted to place myself in Muswell Hill, an area brimming with successful creatives and professionals. I wasn’t just buying a two-bedroom flat; I was buying an environment. I was investing in the person I wanted to become.

The thrill of seizing the imperfect deal

The key to affordability, given my hard-won savings pot, lay in finding something imperfect. I committed to the old saying: buy the cheapest property in the nicest area. The ‘worst house on the best street’. The long-term value is always protected by the premium postcode.

But what truly made this deal possible—and frankly, exciting—were the market inefficiencies that scared off the mainstream buyers. The previous owner was moving back to Bulgaria; they needed a clean, fast exit, giving me powerful leverage. Crucially, the freeholder was absent. This complexity had torpedoed previous sales. Where others saw a deal-breaker, I saw a secret I could unlock. That freeholder problem pushed the price down significantly, giving me the buyer’s edge and the opportunity to seize a discounted asset. The immediate rush of taking on that calculated risk, betting my savings on my ability to secure the freehold later, was an exhilarating feeling. It felt like winning a difficult, high-stakes negotiation.

Finally, a foundation for my own scale

Signing those papers was a moment of immense relief and happiness. I closed on that flat after two years of disciplined saving, having used a tactical retreat and a calculated risk to buy exactly where I wanted to be. It’s a physical manifestation of everything I apply in my product career: efficiency, constraint, and high-judgement calls. Now, walking through the front door with my own keys, I don’t just feel like a successful Product Leader, I feel like I’m finally, securely, home.

Blimey, congratulations! You survived the London property market—that’s a product sprint in itself. Hope the stamp duty wasn’t too painful!

Congrats! Guess your North Star Metric for the year was ‘Square Footage Acquired.’ Major win!

Welcome to the club! Honestly, the whole process is a total nightmare—surveys, solicitors, gazumping—it felt like a full-time job for six months. I remember the relief when the keys finally dropped. Make sure you get that boiler checked, though. Seriously. Enjoy the first pint in your new place, you’ve earned it! Whereabouts did you settle?